estate tax changes effective date

But for all other transfers the amount that can pass free of federal estate and gift tax is limited by the federal estategift tax exemption. The unified estate and gift tax exemption is currently 117 million and is already scheduled to drop in 2026 to around 6 million.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

. While many changes apply to tax years beginning after December 31 2021 ie for most provisions they are to become effective in 2022 this is. This Alert focuses on the changes that directly impact common estate planning strategies. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Additionally the Build Back Better legislation would also reduce the taxable estate exemption by 50 to 585 million for individuals and 117 million for couples meaning that strategies such as Grantor Trusts that currently remove assets from ones taxable estates could be newly relevant for individuals and families whose assets fall. 1 2022 but certain provisions may have proposed effective dates tied to the date of announcement committee action or enactment. The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates subject to.

The House Ways and Means Committee proposal accelerates this reduction lowering the exemption amount to 6020000 after the inflation adjustment effective as of January 1 2022. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax.

The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35 million for transfers at death and 1 million for lifetime gifts. An investor who bought Best Buy BBY in 1990 would have a gain.

See what makes us different. The effective dates of the newly enacted provisions generally are expected to be Jan. The increased exemption amount is due to sunset by its own terms on December 31.

Pending legislation would accelerate this reduction likely effective on January 1 2022. Now here we are in 2021. The lifetime exemption was increased from 55-million to 11-million with adjustments for inflation as part of the 2017 Tax Act.

The proposed plan will accelerate this sunset date to January. It includes federal estate tax rate increases to. And over 1000000000 will be taxed at 65.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1 2022 instead of. Lifetime estate and gift tax exemptions reduced and decoupled. Wealthy individuals who delay estate planning until after any new legislation is passed could face many obstacles.

The applicable exclusion amount from gift and estate tax currently is 117 million per taxpayer and is under current law set to revert to a reduced amount of 5 million per taxpayer adjusted for inflation effective January 1 2026. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Meanwhile it is no secret that the net worths of the wealthy have continued to grow exponentially.

That is the gift tax exemption was 1 million and the estate tax. Reduction in Federal Estate and Gift Tax Exemption Amounts. Over 50000000 but under 1000000000 will be taxed at 55.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. We dont make judgments or prescribe specific policies.

Reducing the estate and gift tax exemption to 6020000 effective January 1 2022. Over 10000000 up to 50000000 will be taxed at 50. However the proposed effective date for almost everything else described in this.

The GST tax is the highest applicable federal estate. The Act changes the rate structure so that estates over 3500000 but under 10000000 will be taxed at 45. See what makes us different.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. With more wealth and substantially less estate planning attorneys skilled in advanced estate tax planning those who maintained their advanced estate planning practices have prospered like never before. The changes would be effective beginning after December 31 2021.

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026.

Personal Income Tax Brackets Ontario 2021 Md Tax

3 Day Closing Disclosure Calendar Graphics Calendar Template 2022

Open House Sign In Sheet For Realtors Increase Your Leads By 400 Template Sumo

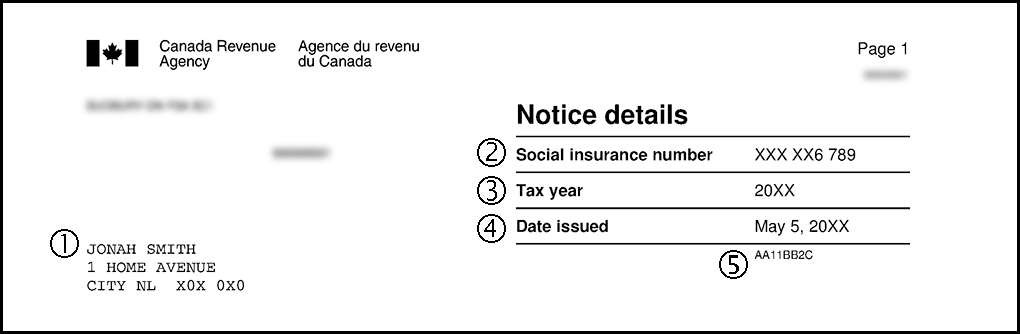

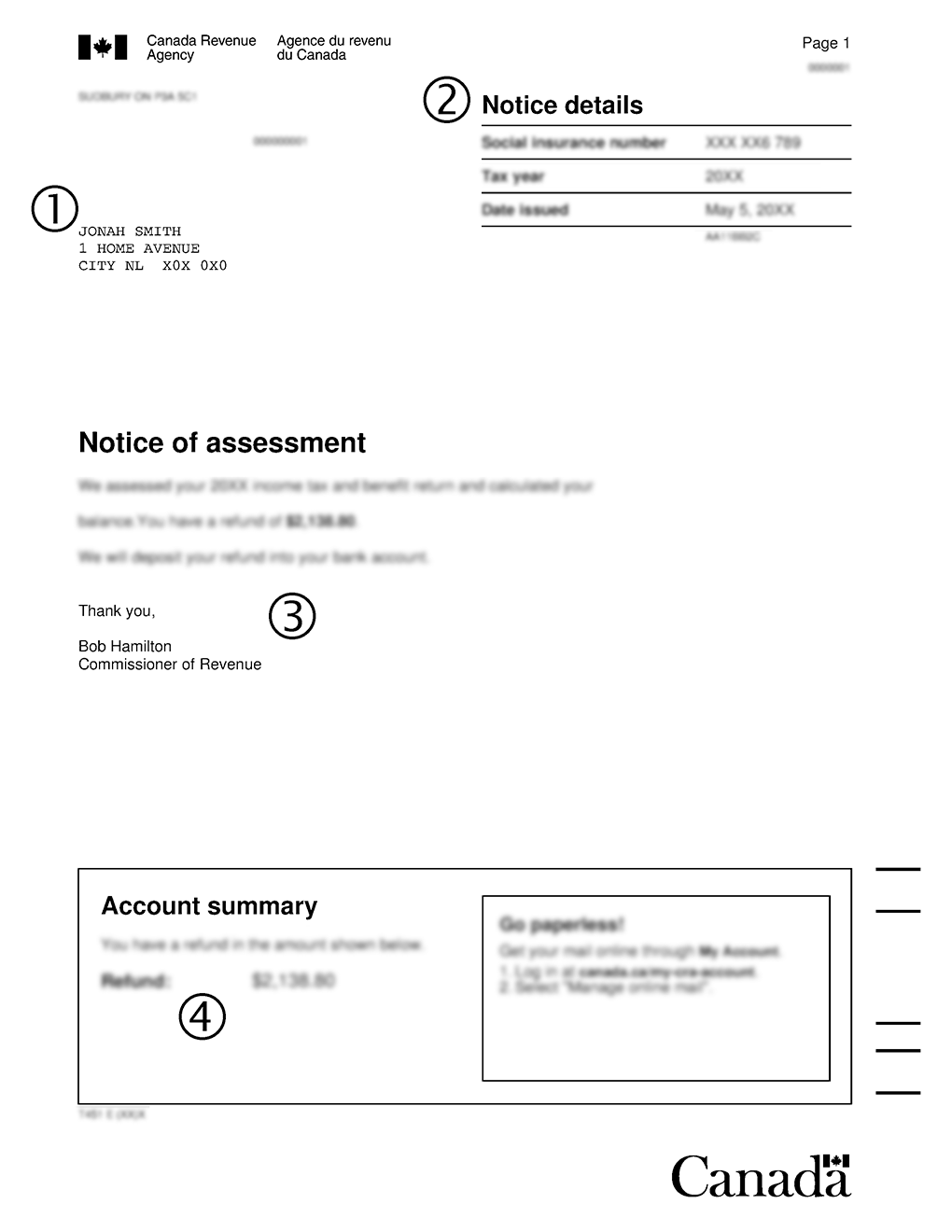

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Tax Update Canada Revenue Agency Prescribed Interest Rates Increasing July 1 2022 Mnp

Check These Tax Filing Deadlines Off Your To Do List

Cra T1135 Forms Toronto Tax Lawyer

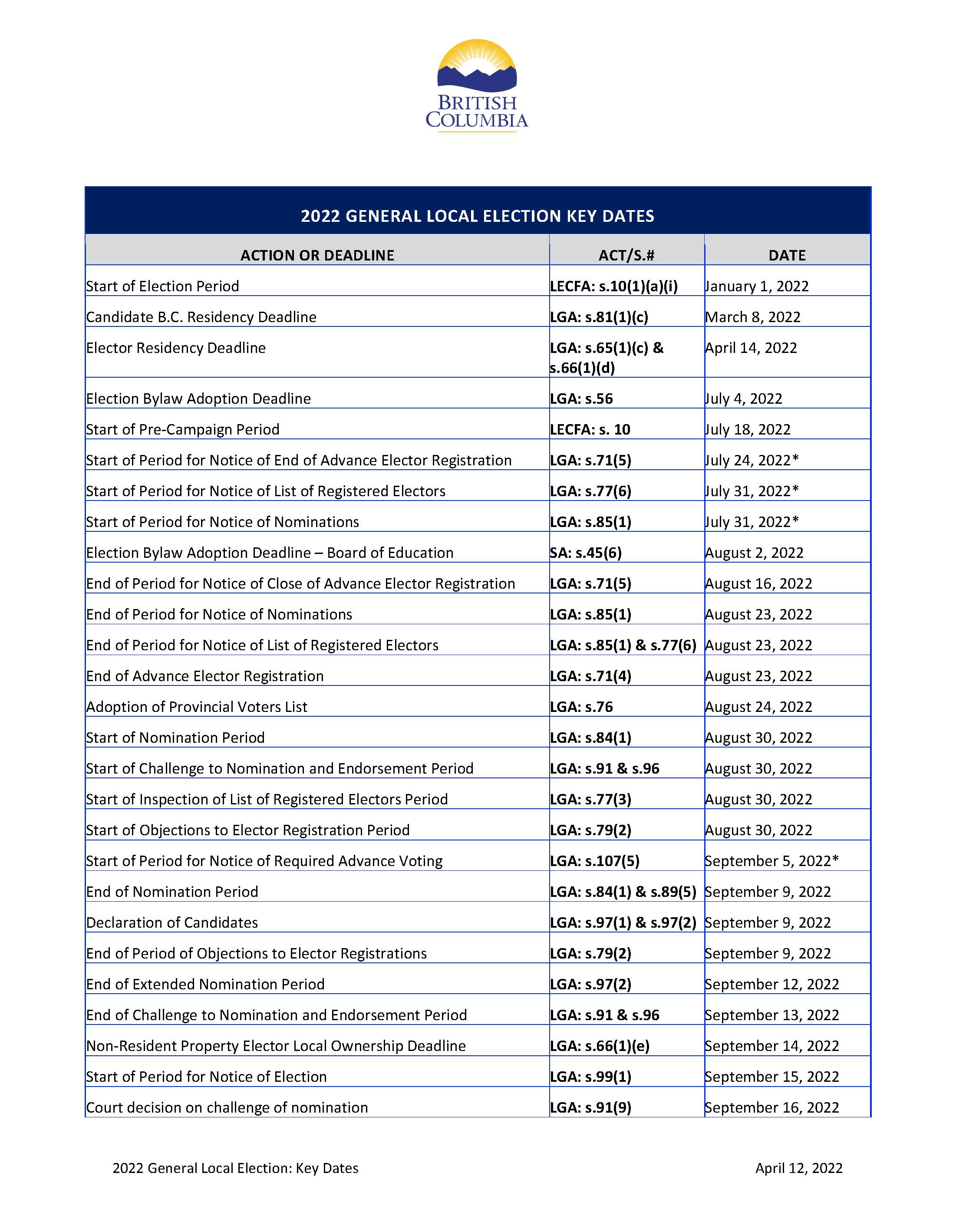

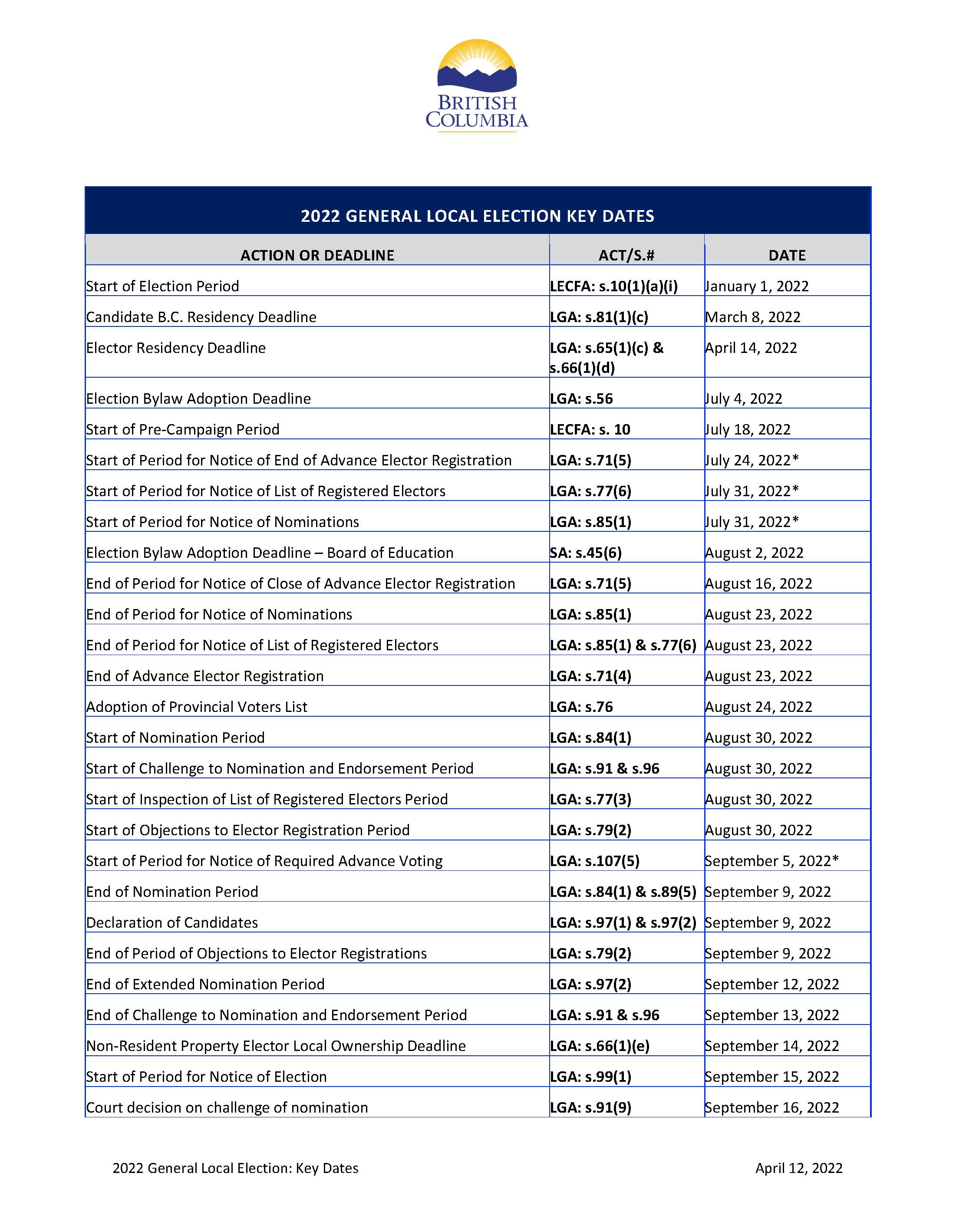

General Local Elections Calendar Province Of British Columbia

Procedure To Process Of Medical Reimbursement Claim Check List For Processing Medical Claim

17 Donation Receipt Templates Free Word Excel Pdf Formats Samples Examples Designs

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

Open House Sign In Sheet For Realtors Increase Your Leads By 400 Template Sumo

4 Home Improvement Projects That Will Pay You Back

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips